Introduction:

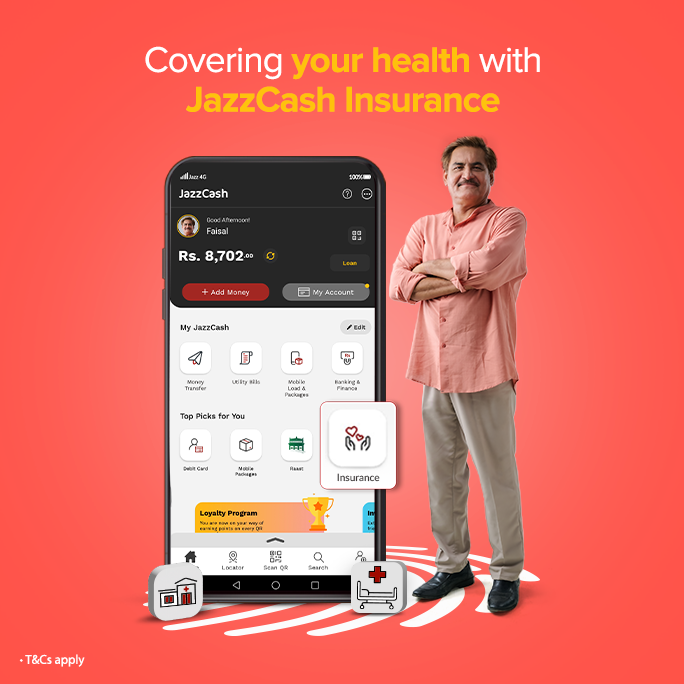

For the first time, JazzCash introduces “Medical Insurance by EFU Life” – an innovative health protection facility for its customers. This plan offers a convenient and secure health Insurance coverage with key benefits such as accidental medical OPD/IPD cover, reimbursement for outpatient expense and EFU mHealth facility for the entire family including parents providing an all-round Insurance protection. Enjoy the assurance of health coverage without lengthy paperwork or prior approval. Get peace of mind with this hassle-free service.

Product Features: :

- Reimbursement for daily hospitalization benefit for the assured customer.

- Accidental OPD/IPD coverage for unforeseen accidental expenses.

- Outpatient coverage with reimbursement for expenses as prescribed by EFU mHealth panel doctors

- Free doctor consultations for the entire family (including parents) via the EFU mHealth app or landline Tele-Health Facility

- Simple Enrollment Process: A paperless process that allows enrollment within minutes with no medical examinations required