By choosing to use this Instant Loan Service ("SERVICE") you agree to establish a direct contractual relationship with Mobilink Microfinance Bank Limited ("BANK") as a

Merchant/borrower and you further agree to be bound by the BANK's terms and conditions of use of the SERVICE and undertake to repay the Instant Loan amount along with

all the due charges on the agreed date and time.

1. APPLY FOR INSTANT LOAN

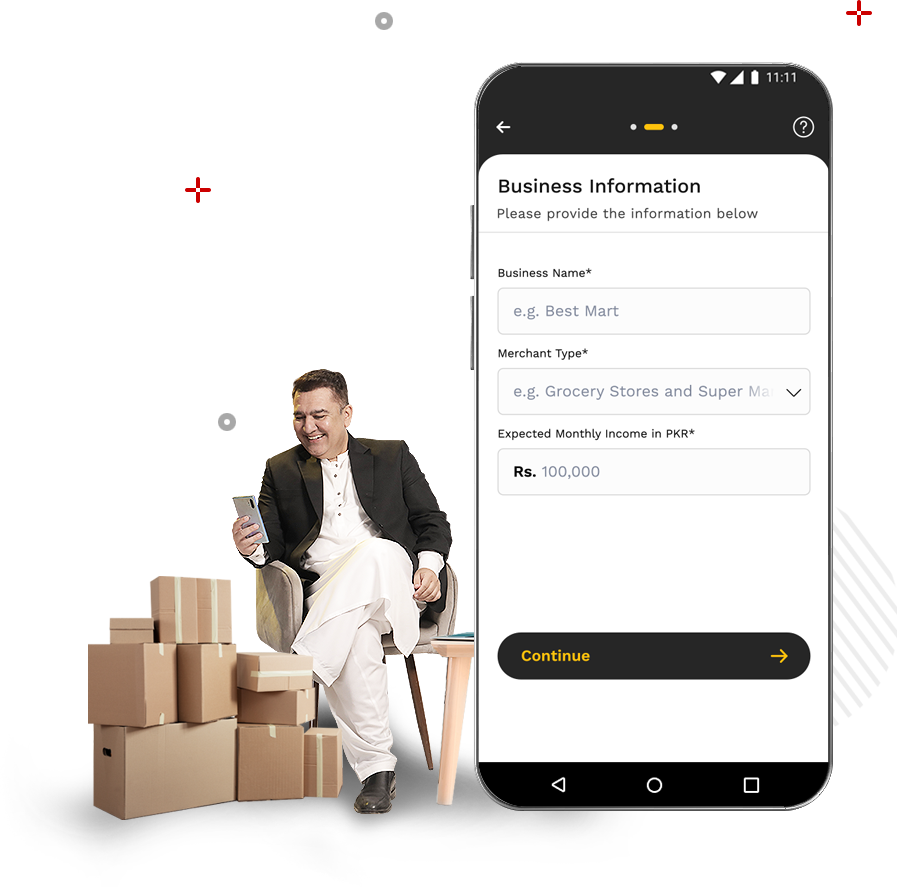

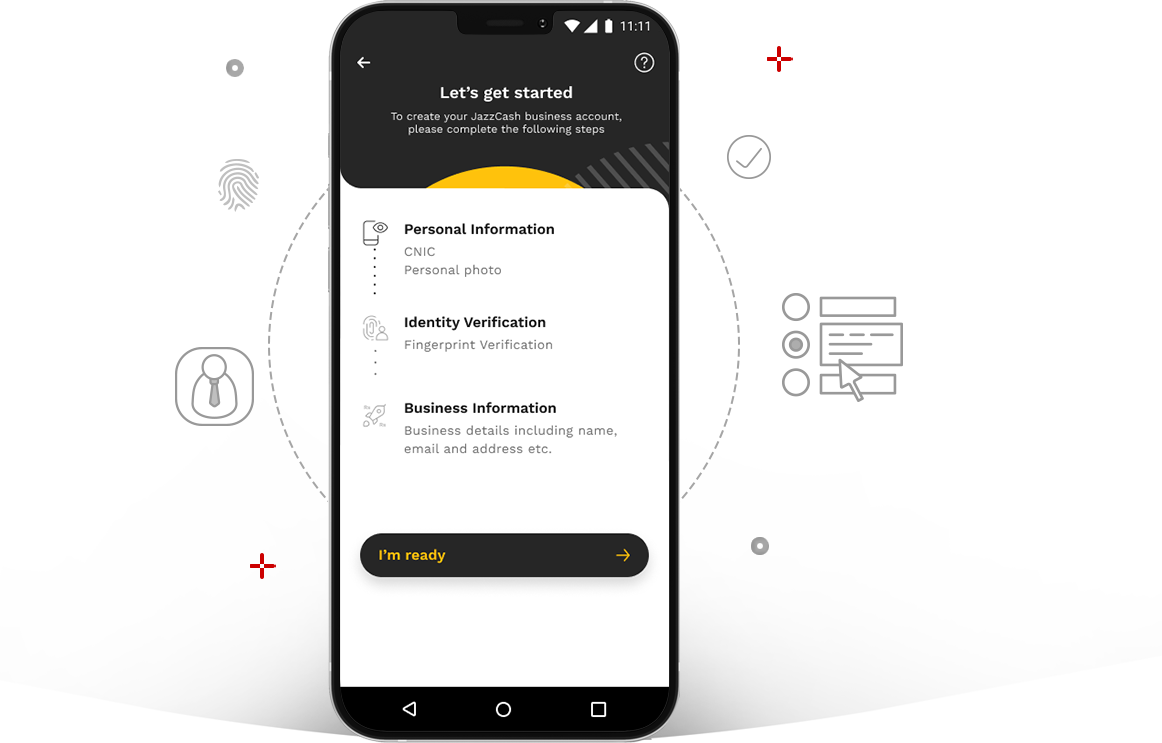

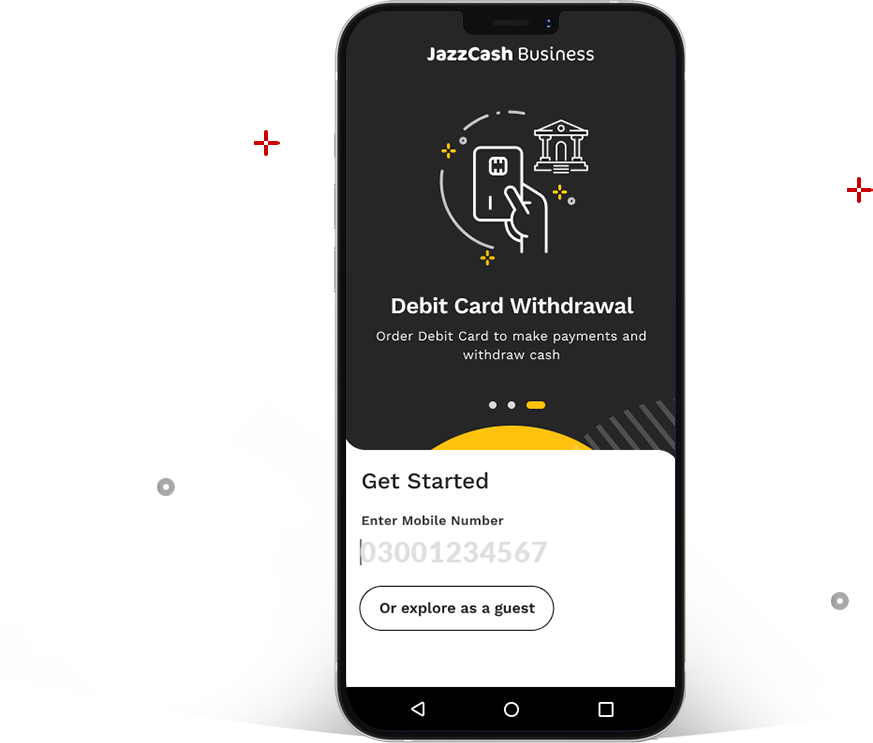

1.1. Merchant should have a JazzCash Business account.

1.2. Merchant has an active mobile account Usage.

1.3. When you apply for a loan, you instruct, consent to, and authorize Mobilink Microfinance bank for considering your Instant Loan service.

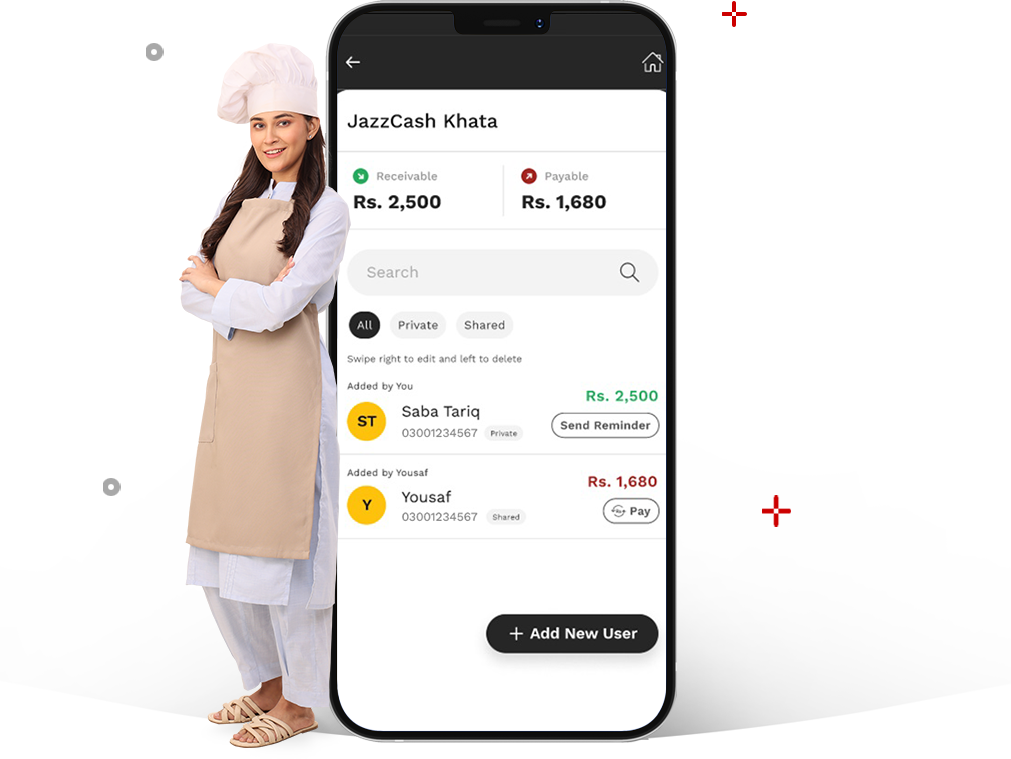

1.4. To provide you with the best user experience consistent with our company policy of being user obsessed, we must establish your

relevant Merchant profile which would include access to relevant personal information, mobile account and subscription information.

By accepting the terms and conditions you consent that the Instant Loan service will grant the BANK authority to access and process the above stated requirements

for the purposes of offering best products and services.

1.5. Once Merchant’s Instant Loan request is approved, loan will be disbursed directly into your mobile account and an SMS confirmation will be sent.

1.6. The BANK shall not be required to provide reasons to you for declining or approving your application for an Instant Loan.

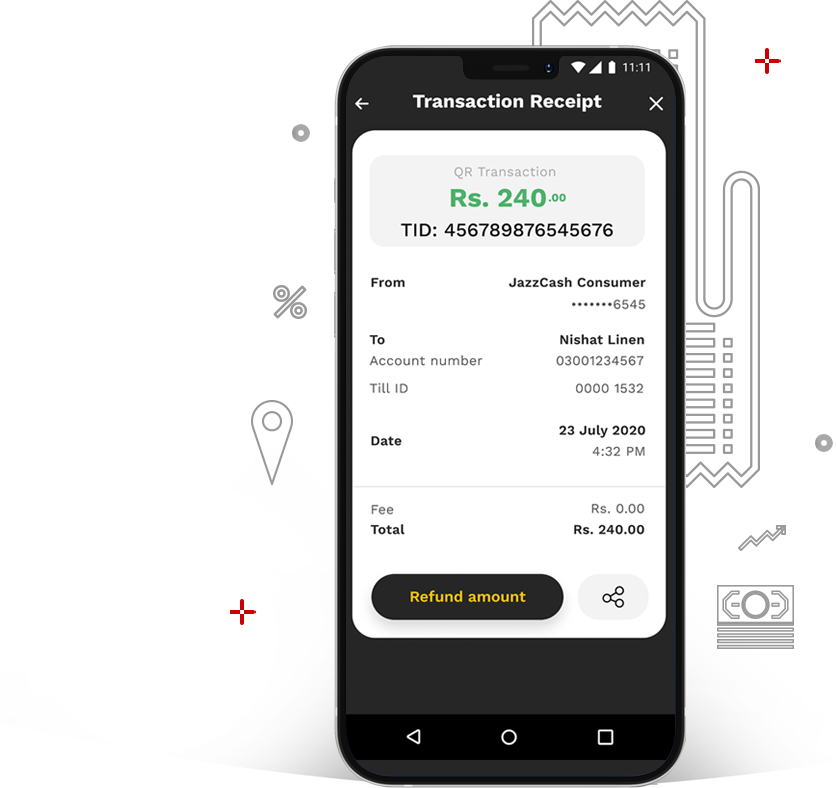

1.7. If your application is approved, the Bank shall send an SMS to you confirming:

- 1.7.1. The Loan Amount

- 1.7.2. The Daily Fee

- 1.7.3. The Total Repayment Amount

- 1.7.4. The Due Date

- 1.7.5. The Transaction ID (TID)

1.8. These terms and conditions may change over time and will be available on JazzCash website. Therefore, whenever you are requesting for instant

loan, you need to review these terms before you apply for a Instant Loan.

2. REPAYMENT OF THE LOAN

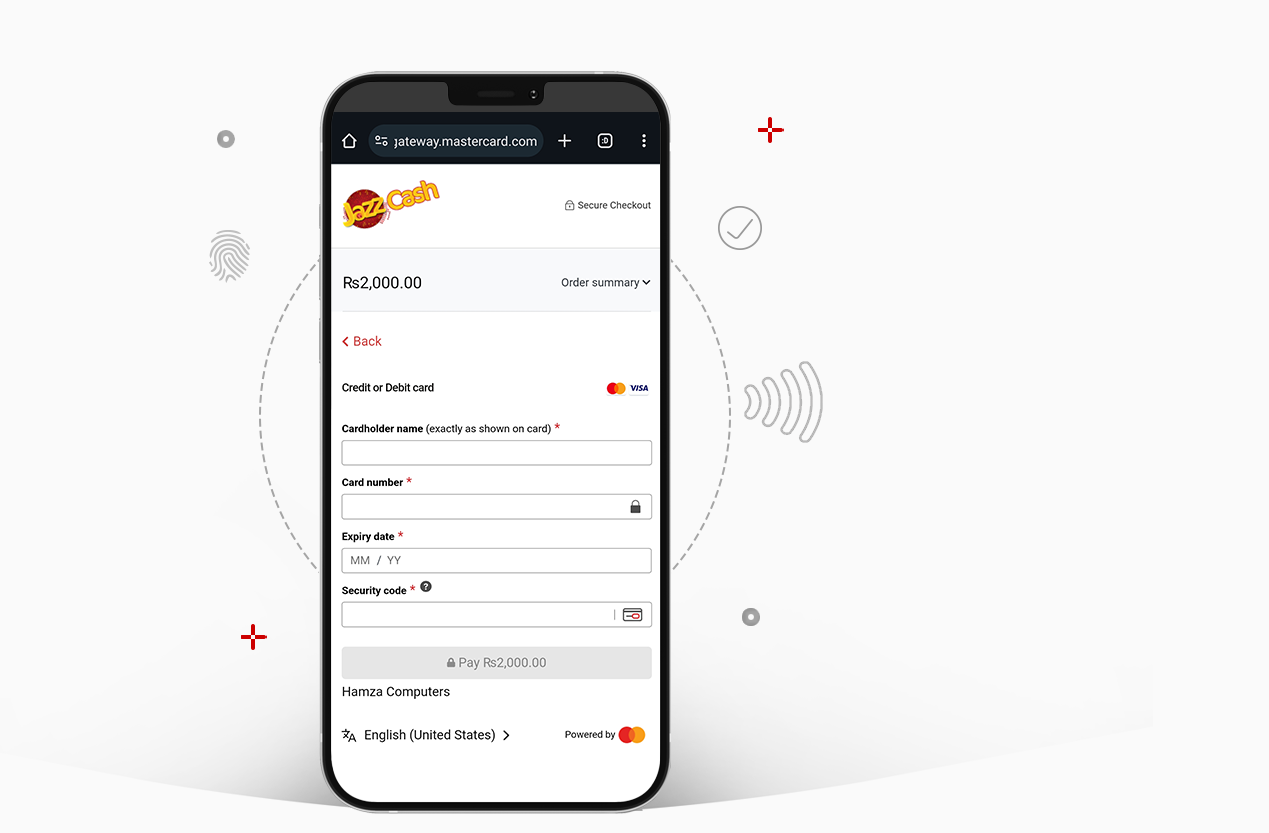

2.1. You can repay your loan using mobile account at any time on or before the due date, by selecting the ‘Repay Instant Loan’ option. Jazz users can also repay the loan through USSD channel.

2.2. The Bank is authorized to process automatic deduction of the repayment amount of outstanding Instant Loan amount from your mobile account after due date, automatic deduction can be processed one or more times until repayment of the outstanding balance plus applicable fees has been made in full.

2.3. After 28 days since loan disbursement, there will be no further daily fee applied on outstanding Instant Loan amount.

2.4. Merchant authorizes Bank that they may receive notifications/alerts regarding their Instant Loan.

3. MERCHANT DEFAULT

3.1. The Merchant will be deemed a defaulter if they fail to pay the original loan amount along with its applicable fee

and any associated fee within a stipulated time period.

3.2.1 Default Merchant data can be reported to Credit Bureau (eCIB) service of State Bank of Pakistan and will remain in the eCIB

system for a period of two years. In case of any financial relief provided to the Merchant by the Bank in the form of write off / reversal of markup,

the same shall be reported to eCIB/SBP. Default Merchant can be blacklisted from availing Instant Loan service again in future.

4. EXCLUSION OF LIABILITY

4.1. Once loan has been granted, Instant Loan will not be liable or accountable for how the merchant uses their loan amount. Responsibility of any illegal,

questionable, or dubious action will fall solely on the consumer.

5. DISCLOSURE OF INFORMATION

5.1. You provide your consent and authorization to the Bank, JazzCash, Jazz Mobile subscription, Jazz Digital (PMCL) and its associated bodies

where your relevant information was extracted from during your loan application to share that relevant data with:

5.1.1. Any national or international law enforcement, regulatory or government body/agency in the assistance in any investigation, prosecution of criminal activities, fraud, prevention and detection of any such activities

5.1.2. 5.1.2. Service providers, dealers, agents, associate company of the Bank or any Third-Party entity associated directly with the Bank for reasonable commercial purposes which can include disbursement of loan, its regulation, collection, marketing of products etc.

5.2. The Bank is authorized to make such disclosures in respect of the Account and Services as may be required by any court order or competent authority

or agency under the provisions or applicable laws and/or otherwise to safeguard the interests of the Bank

5.3. Service providers and any other associate company of the Bank for reasonable commercial purposes

5.4. Default Merchant data can be reported to Credit Bureau of Pakistan

6. Maximum Exposure of a Borrower from Financial Institutions

6.1. By agreeing to the T&Cs, Merchant confirms that his/her maximum limits of aggregate exposure do not exceed Rs. 350,000/- for general loans.

6.2. By agreeing to the T&Cs, the Merchant confirms his/her aggregate exposure to avail both general and microenterprise loans do not exceed Rs. 3,000,000/-.

By agreeing to these Terms & Conditions for Instant Loan Service, the Merchant is also agreeing to the Mobile Account Service Terms & Conditions published on

https://www.jazzcash.com.pk/tc/