Introduction:

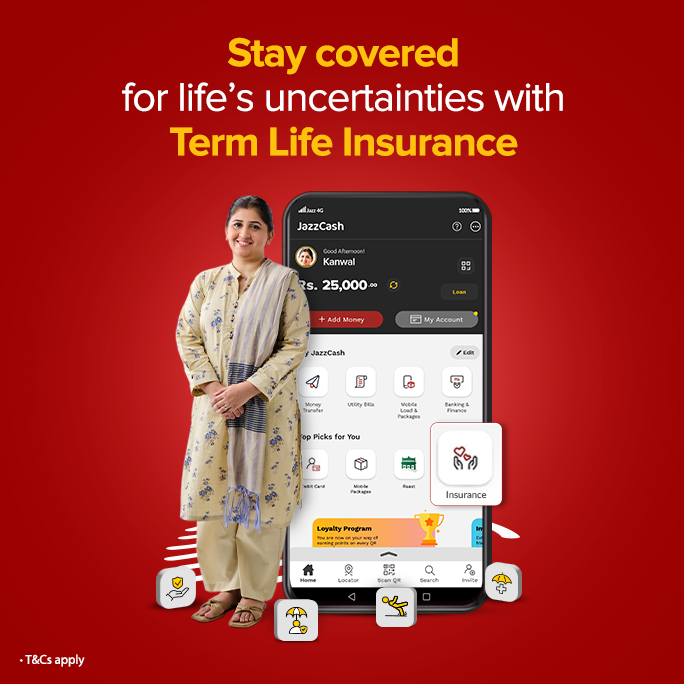

For the first time, Jazz Cash in collaboration EFU brings “Term Life Insurance” – An innovative Life and Health Protection facility for its customers.

The plan offers a convenient and secure way to purchase life and health Insurance plans. Get the assurance of life and health coverage without going through lengthy paperwork or seeking prior approval. Keep your peace of mind with the security that you and your loved ones are taken care of with just one purchase. It covers the financial needs to ensure life and health coverage for you. You can purchase these Insurance plans using your Jazz Cash Mobile Accounts instantly. With this hassle-free and straightforward service, customers no longer need to go through time-consuming documentation processes, carry life and health Insurance cards or seek permission before treatment.

Product Features:

- Provides a pre-determined sum of money to beneficiaries if the insured passes away due to natural causes (illness, old age).

- Covers medical expenses incurred from injuries due to accidents.

- Includes hospital stays, surgeries, medications, and other related costs.

- Alleviates the financial burden of unexpected medical expenses.

- Offers a payout that is twice (2x) the standard benefit amount for accidental death.

- Provides increased financial support to beneficiaries in case of accidental death compared to natural death.

- May include provisions for critical illness coverage, disability benefits, or other forms of financial assistance.